We are using a merchant for PayPal and Stripe so in order to buy from their gateway you have to buy a minimum of 100 PKR equivalent.

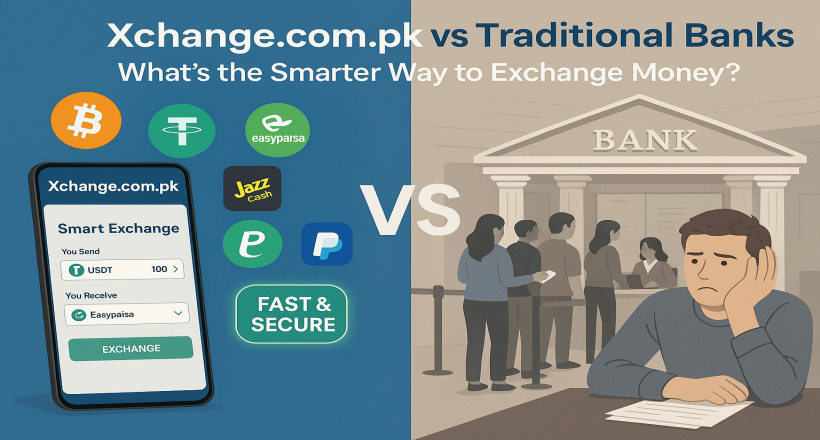

In today’s fast-paced digital economy, money exchange has become more accessible than ever. Whether you're sending money abroad, buying cryptocurrency, or managing e-wallets like JazzCash, Easypaisa, or PayPal, choosing the right platform matters. Two main options dominate this space: online exchangers like Xchange.com.pk and traditional banks.

But which is the smarter choice in 2025? Let’s break it down.

Offers real-time digital exchanges.

Supports multiple platforms including Skrill, PayPal, JazzCash, Easypaisa, Binance, USDT, and more.

Fast transactions—often completed within minutes.

Entire process is online—no branch visit required.

Slower processing time (1-3 business days for international transfers).

Requires physical visits, paperwork, and longer verification processes.

Limited availability of digital wallets and crypto exchanges.

✅ Winner: Xchange.com.pk — especially for people who value speed and online access.

Competitive and transparent exchange rates.

Minimal service fees compared to traditional banks.

Live rate calculator available on the website.

Higher exchange margins.

Hidden fees for international and inter-wallet transactions.

Currency conversion rates are often less favorable.

✅ Winner: Xchange.com.pk — for cost-effective and budget-friendly transactions.

Buy/sell digital currencies like Bitcoin, USDT, Ethereum.

Wallet-to-wallet services: Payoneer to JazzCash, Skrill to Easypaisa, etc.

E-wallet recharge and cash-out features.

Integration with freelance and gig economy platforms.

Primarily limited to fiat currency transfers.

Rare or no support for crypto, online wallets, or micro-wallets.

Lack of flexibility in freelance income processing.

✅ Winner: Xchange.com.pk — perfect for freelancers, crypto users, and e-wallet users.

Trusted by thousands of Pakistani users.

SSL encrypted, verified, and secure transactions.

24/7 customer support and social media presence.

Regulated by State Bank of Pakistan.

Insurance-backed and well-established.

✅ Winner: Tie — Banks have institutional trust, but Xchange.com.pk has built a strong reputation in the digital space.

Available 24/7—no waiting for bank hours.

Mobile-friendly and web-based platform.

Great for remote users and tech-savvy individuals.

Limited by business hours and holidays.

Less flexible in rural or underbanked regions.

✅ Winner: Xchange.com.pk — more accessible and user-friendly.

If you’re dealing with cryptocurrencies, freelancing income, online wallets, or international transfers, Xchange.com.pk is clearly the smarter and more flexible solution in 2025. Traditional banks still have their place for large-scale business or government transactions, but for everyday use, digital exchangers win in speed, cost, and convenience.